Practice Areas

Estate Planning

Our services include helping you draft a thoughtful will and guiding loved ones through the process.

Estate PlanningReal Estate Law

We can guide you through the process of buying or selling a home, clearing title issues or preparing deeds to transfer the property.

Real Estate LawBankruptcy

We can help you file for bankruptcy, avoid foreclosure, and provide other debt relief guidance.

BankruptcyHelping Clients Build A Better Future

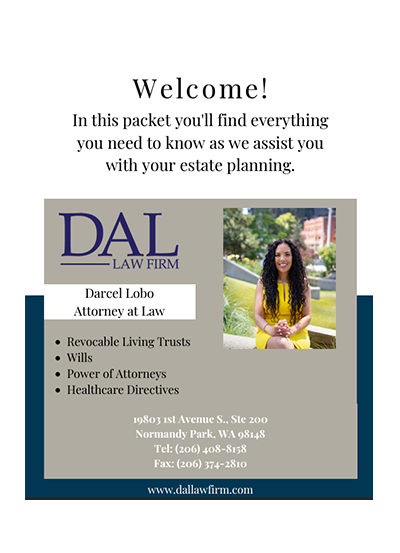

Conveniently located in Normandy Park and serving the surrounding communities in King County, DAL Law Firm is owned by attorney Darcel Lobo. Our clients are often pleasantly surprised by our firm’s willingness to listen to their questions and concerns. We believe that experience and knowledge are the bedrock of good legal guidance, but we also have the patience and empathy to understand that many of our clients go through difficult times.

We have extensive experience providing solutions to clients facing financial challenges. Whether it is filing Chapter 13 bankruptcy or saving a home from foreclosure, we understand how these difficult processes work. We guide you through it so you and your family can get the fresh start you deserve.

Create An Estate Plan

We also work with families to draft and implement estate plans to protect assets they have acquired and wish to protect for their loved ones. We can draft a revocable trust, along with power of attorneys. The estate plan that we create will be tailored to your specific needs, giving you peace of mind that your family will have guidance at a difficult time.

Get A Fresh Financial Start

We have extensive experience providing solutions to clients facing financial challenges. Whether it is filing Chapter 13 bankruptcy or saving a home from foreclosure, we understand how these difficult processes work. We guide you through it so you and your family can get the fresh start you deserve.

Meet Our Attorney

Experienced And Knowledgeable Real Estate Guidance

We go through the entire process with our clients, offering effective legal advice based on years of working in the area to minimize concerns or risk. If your financial circumstances change, we can also help you renegotiate your loan or mortgage so you do not lose your home.

Contact Us Today To Hear How We Can Help

No matter what legal and life challenges you face, we always believe there is a light at the end of the tunnel. DAL Law Firm will help get you to that solution. To hear how we can help, call 206-408-1688 or contact us online.

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.